For the Investor

Supporting Investors with disciplined analysis and scalable execution.

We partner with growth-stage and mid-market investors to assess portfolio performance, strengthen go-to-market foundations, and accelerate revenue outcomes. Whether evaluating an opportunity, managing through transformation, or preparing for exit, we provide clear diagnostics, execution muscle, and actionable insight.

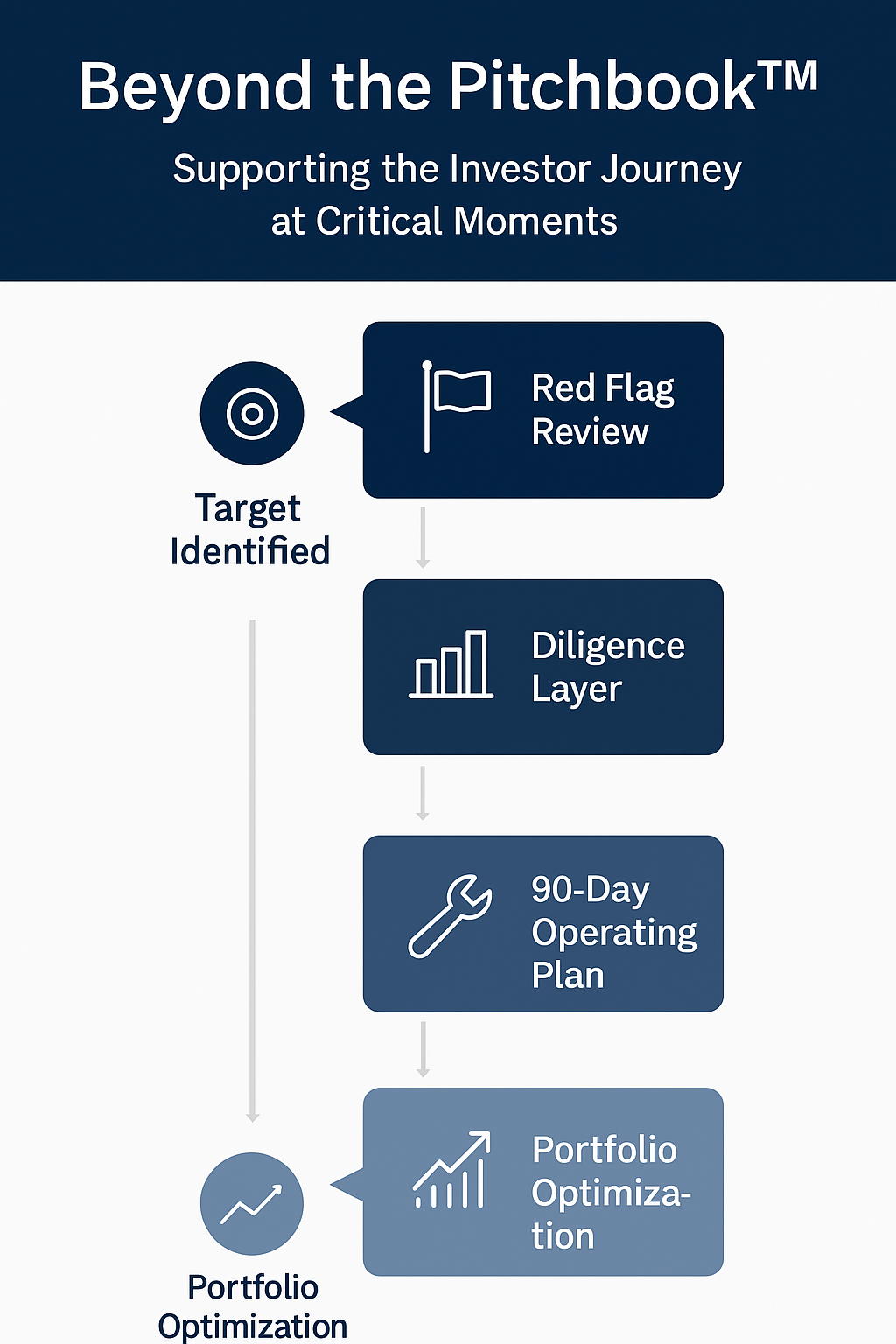

Investor Services: Beyond the Pitchbook™

Objective, operator grade assessment and execution support that turns diligence insight into action and demonstrable results.

Red Flag and Thesis Validation

Expedited assessment of commercial, operational, and technology risks to decide go or no go.

- Summary report & scorecard

- Key Findings & SWOT

- Items in need of investigation

Operator Diligence

Deeper operator grade diligence that validates or reframes the thesis and sets up execution.

- Deep dives & impact model

- Practical roadmap

- Board ready readout

Ninety Day Operating Plan

Post investment, convert diligence into action with clear owners and cadence.

- Initiatives with accountable owners

- Quick wins

- Impact tracking

Portfolio Optimization

Investor-led, company-specific value creation.

- As-Is → To-Be analysis

- Execute focused sprints with management

- Move the few levers that matter.

Red Flag and Thesis Validation

Purpose: A time-bound assessment of risk and commercial potential to support go/no-go decisions.

When to use: Pre-bid view, portfolio health check, or rapid thesis screen before deeper work.

Timeline: Two to three weeks, defined scoped.

Inputs: Focused interviews, light data pulls, and key artifacts.

What we do: Rapid signal gathering across go to market, pricing, product, pipeline, execution, and reporting, with confidence ratings. We may apply a diagnostic module narrowly where it improves decision quality.

Deliverables:

- Concise summary report

- Risk and opportunity scorecard with severity and confidence

- Key findings (strengths and gaps)

- Risk areas in need of investigation with suggested probes

- Opportunities and near term actions

- Pointers to critical data, metrics, and artifacts that will impact thesis and valuation

- Evidence snapshots pulled from interviews and data

- Clear decision paths, proceed, pause, or escalate to Operator Diligence

Not included: root cause analysis, customer studies, or a 30, 60, 90 plan.

Operator Diligence

Purpose: Operator grade diligence that validates or reframes the thesis and sets up execution. May follow Red Flag or start here for buyer or seller.

Approach: Integrated with your deal team, we execute focused deep dives, targeted customer and market checks, and apply our diagnostic modules in step with legal, finance, and technical workstreams.

Deliverables:

- Thesis validation memo with root cause analysis and risk profile

- Workstream deep dives with source notes and evidence

- Quantified impact model tied to revenue and cash flow

- Practical execution roadmap with 30, 60, 90, owners, and milestones

- Board ready readout pack

Diagnostics (expand to view)

Revenue Reality Diagnostic (RRD)

Evaluates go to market health and execution risk.

- GTM scorecard

- SWOT

- Prioritized action plan

Ideal for: Diligence, board resets, or post-close assessment

Tech Stack Transparency (TST)

Maps systems and automation to growth stage and identifies leverage points.

- Tech stack map

- Opportunity analysis

- Roadmap

Ideal for: Scaling companies or prepping for operational lift

Market Validation & Fit Index (MVFI)

Verifies ICP, value proposition resonance, and demand alignment.

- Validation report

- Positioning framework

- GTM refinements

Ideal for: Pre-round inflection, GTM pivots, or early launches

Note: Red Flag may apply a tool narrowly if scope allows; full use sits within Operator Diligence. Scope, team, and depth are calibrated to the investment thesis and the access available.

Ninety Day Operating Plan

Purpose: Turn the deal thesis and diligence output into a clear first ninety days of action that creates early wins, reduces risk, and sets the operating cadence.

Approach: Establish the As-Is state across go to market, product, customer success, and financial perfomance; define the To-Be operating model tied to the thesis; and run a short transition plan that closes gaps with clear owners, a weekly rhythm, Day 1 readiness, and early wins.

Deliverables:

- Ninety day plan with value targets, owners, and weekly milestones

- Workstream charters across product, tech, go to market, customer success, and finance

- Risk register with mitigations and decision gates

- Opportunity register with size, confidence, owner, and 90-day sequencing (linked to As-Is → To-Be gaps)

- Operating dashboard with a small set of lead and lag indicators

- Financial impact, resource plan, and dependency map

What we use: Revenue Reality Diagnostic, Tech Stack Transparency, Market Validation and Fit Index, customer and pipeline reviews, support tickets, and product usage data.

Evidence of impact: Time to value measured in weeks, lift in conversion and expansion, lower churn risk, and faster cycle time on the top three initiatives.

Typical timeline: Plan design in two to three weeks, launch on Day 1, weekly working sessions and a 30, 60, 90 review.

Portfolio Optimization

Purpose: Investor-led, company-specific value creation. We enter on the investor’s behalf to partner with the CEO and functional leaders, isolate the two or three levers that most affect revenue, margin, retention, and cash, and install an operating rhythm that sustains results.

Approach: Run a focused As-Is → To-Be scan across go-to-market, product, customer success, finance, and data; align investor and management on a company-specific value thesis; then execute four-to-six-week sprints with clear owners, milestones, and weekly governance. We act as the investor’s operating partner—augmenting management without displacing it—and maintain a concise board-ready narrative of progress and risk.

Deliverables:

- Company value map and As-Is → To-Be gaps tied to the investment thesis

- Financial As-Is baseline and To-Be impact model (e.g., three-year view showing expected effects of the selected levers on growth, margin, retention, and cash)

- Two-quarter value creation plan with targets, owners, and milestones

- Sprint backlogs and workstream charters (commercial, product/tech, CS, finance)

- Pricing, packaging, and expansion plays as applicable

- Operating dashboard and board-ready narrative with leading/lagging indicators

- Opportunity register and risk log aligned to the plan

What we use: Revenue Fusion’s diagnostic modules including key criteria such as: retention views, pricing/discount data, product and data architecture reviews, customer and pipeline insights, and operating metrics.

Evidence of impact: Visible movement in revenue growth, gross margin, net retention, and cash conversion; faster cycle time on priority initiatives; cleaner board narrative and exit readiness.

Typical timeline: ~2 weeks for initial scope and plan; 1–2 execution sprints per quarter with a weekly operating call and a monthly investor steering review.

Let’s Talk About What’s Beyond the Pitchbook™

Request a working session. Share a target or a portfolio concern and we will provide a short plan for next steps and expected impact.